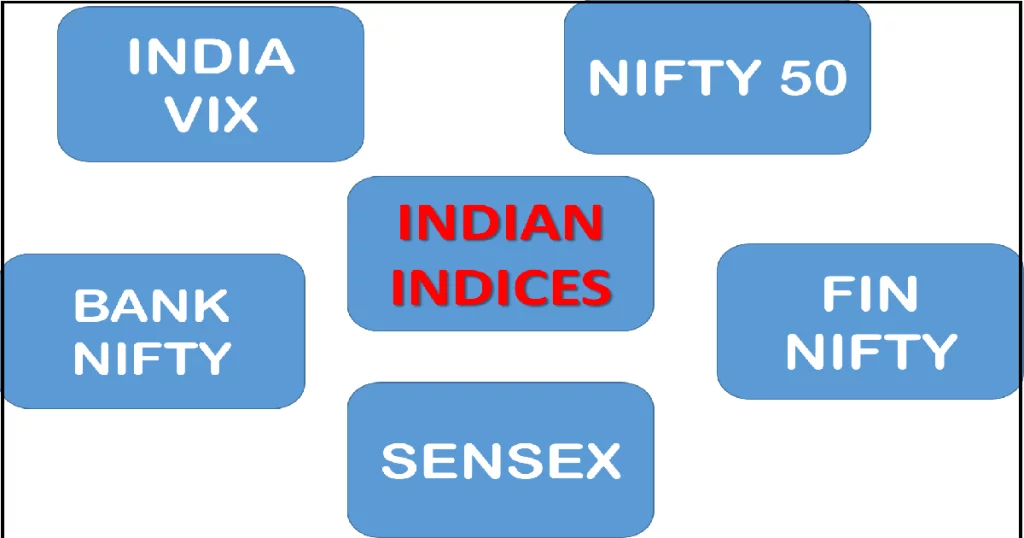

Share market indices play a pivotal role in the world of finance, serving as barometers that gauge the overall health and performance of financial markets. These indices are essentially baskets of selected stocks that represent a specific segment of the market or the market as a whole. In this article, we delve into the essence of share market indices, exploring two key reasons why they hold significant importance in the financial realm. Indian share market indices

Benchmarking and Performance Evaluation

One of the primary roles of share market indices is to serve as benchmarks for various investment portfolios. Investors and fund managers use these indices as yardsticks to assess the performance of their investments against the broader market trends. For instance, if an investor holds a portfolio of stocks, they might compare the returns of their portfolio with that of a relevant market index to gauge the relative success of their investment strategy.

Benchmarking against indices helps investors set realistic expectations, evaluate risk-adjusted returns, and make strategic decisions regarding their investment allocations. It provides a standardized measure that enables investors to ascertain whether their investment decisions have outperformed or underperformed the broader market, guiding them in refining their investment strategies.

Economic Indicators and Sentiment Analysis

Share market indices also serve as critical economic indicators, reflecting the overall health of the economy. Movements in indices can be indicative of broader economic trends, providing insights into factors such as economic growth, inflation, and market sentiment.

For instance, a rising stock market index may be seen as a positive sign, suggesting confidence in the economy and expectations of future growth. On the other hand, a declining index may indicate concerns about economic stability or impending challenges. Policymakers and central banks often monitor these indices to assess the effectiveness of economic policies and to make data-driven decisions.

Moreover, share market indices contribute to sentiment analysis. The psychology of investors plays a crucial role in market dynamics, and indices are often used as sentiment indicators. Sudden fluctuations or sharp declines in indices may be reflective of investor panic, uncertainty, or exuberance, providing valuable information for market participants.

Share market indices are not just numbers on a screen; they are dynamic indicators that encapsulate the complexities of financial markets and the broader economy. From benchmarking investment portfolios to serving as economic barometers, these indices play a multifaceted role in the world of finance. Investors, analysts, and policymakers rely on them to make informed decisions, understand market dynamics, and navigate the intricate web of global finance. As we continue to witness the evolution of financial markets, the significance of share market indices is likely to endure, shaping the way we perceive and engage with the ever-changing landscape of investments. Short Selling